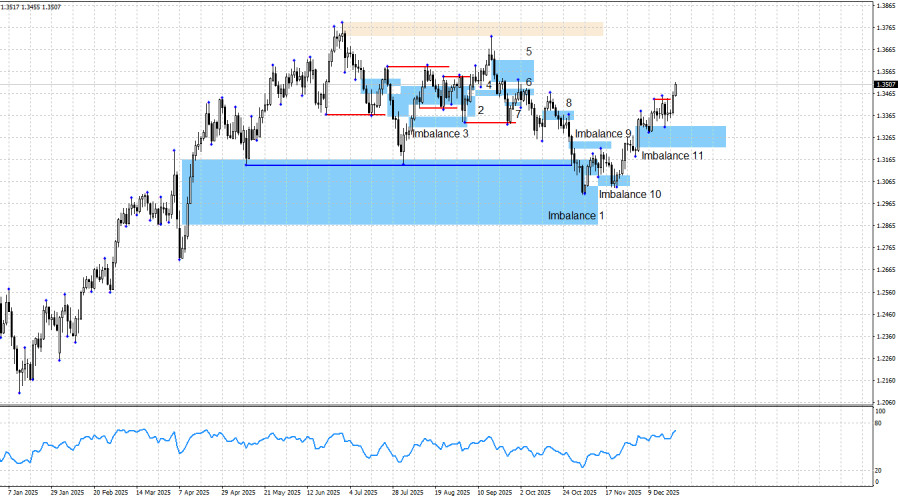

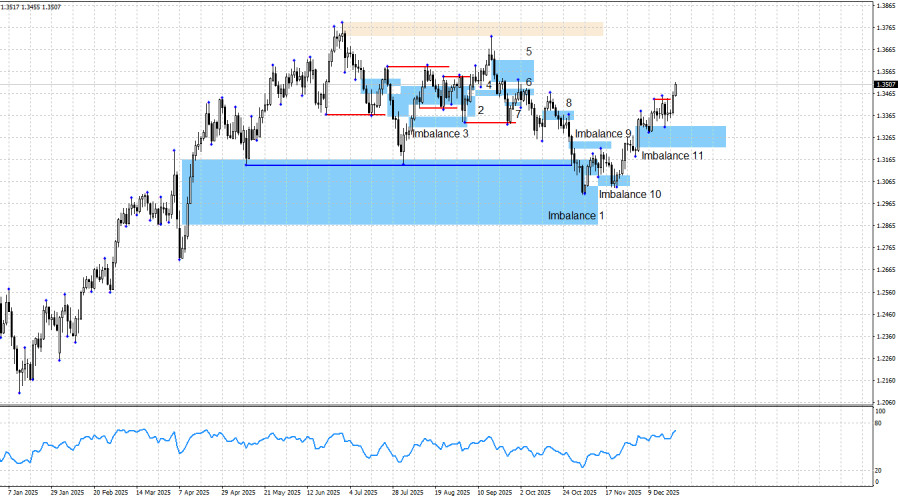

The GBP/USD pair rebounded from the "bullish" imbalance 11 and resumed its upward movement, exactly as I expected. This is already the second reaction to bullish imbalance 11; the first buy signal appeared back last week. In fact, I do not take such signals into account on their own. If an imbalance has already been worked off (no matter to what extent), then in the future I am interested only in signals combined with liquidity grabs. This time, there was no sweep of "bearish" liquidity—but what difference does that make if a few days earlier another bullish signal was formed within the same bullish imbalance 11? Thus, traders can continue to hold long positions open, as I see no clear signs that the bulls' offensive is coming to an end. At the moment, these positions are already showing profits of about 400 points by conservative estimates.

The current chart picture is as follows. The "bullish" trend in the pound may be considered complete, but the "bullish" trend in the euro is not. As a result, the European currency may continue to pull the pound higher, although the pound itself has been rising quite well over recent weeks. Bulls have pushed off bullish imbalance 1, bullish imbalance 10, and twice from bullish imbalance 11. A large number of buy signals have been formed. There are no bearish patterns above the current price for the pound—there is nothing to stop the rise. Therefore, I expect growth toward the yearly highs, around the 1.3765 level.

On Tuesday, reports on U.S. GDP, industrial production, and durable goods orders were released, but I see little point in focusing on them, as the pound has been rising this week even without a supportive news background. On Monday, the UK released its third-quarter GDP report, which was not strong enough for bulls to launch a new attack ahead of Christmas. Today, the pound was rising even before the U.S. reports were published.

In the United States, the overall news background remains such that, in the long term, nothing but a decline in the dollar can be expected. The situation in the U.S. remains quite challenging. The government shutdown lasted a month and a half, and Democrats and Republicans agreed on funding only through the end of January. There was no U.S. labor market data for a month and a half, and the latest figures can hardly be considered positive for the dollar. The last three FOMC meetings ended with "dovish" decisions, and the latest labor market data allow for a fourth consecutive easing of monetary policy in January. In my view, the bulls have everything they need to continue a new offensive and return to the yearly highs.

A bearish trend would require a strong and consistently positive news background for the U.S. dollar, which is difficult to expect under Donald Trump. Moreover, the U.S. president himself does not need a strong dollar, as the trade balance would remain in deficit in that case. Therefore, I still do not believe in a bearish trend for the pound, despite the fairly strong decline that lasted two months. Too many risk factors continue to hang like dead weight over the dollar. The current bullish trend can be considered completed, as prices fell below two lows (from May 12 and August 1), but on what basis are the bears supposed to push the pound further down? Precisely because I cannot answer this question, I do not believe that the dollar's decline will continue. If new bearish patterns appear, a potential decline in the pound can be reconsidered.

News calendar for the U.S. and the UK:

- U.S. – Change in initial jobless claims (13:30 UTC).

On December 24, the economic calendar contains one secondary event. The impact of the news background on market sentiment on Wednesday will be extremely weak or absent.

GBP/USD forecast and trading advice:

For the pound, the picture is beginning to look more pleasing to the eye. Three bullish patterns have been worked out, signals have been formed, and traders can continue to hold long positions. I see no informational grounds for a bearish trend in the near future.

A resumption of the bullish trend could have been expected already from imbalance zone 1. At this point, the pound has reacted to imbalance 1, imbalance 10, and imbalance 11. As a target for potential growth, I am considering the 1.3725 level, although the pound could rise much higher—albeit next year. If bearish patterns form, the trading strategy may need to be reconsidered, but for now I see no reason to do so.