The GBP/USD currency pair actively recovered on Friday. While the euro stagnated throughout the previous week, the pound traded quite actively. There were reasons for this, though they were formal nonetheless. Recall that the Bank of England made the expected decision to keep its monetary policy parameters unchanged. Still, Andrew Bailey warned about the possibility of accelerating inflation in the coming months amid higher economic growth rates at the beginning of the year. Although it would have been more logical to keep the key rate unchanged under such circumstances, the Monetary Policy Committee took the corresponding decision by just a one-vote margin. This minimal lead of the so-called "hawks" played a trick on the British pound.

However, on Friday, the British currency began to recover as the market recognized a simple fact—that the next BoE meeting's decision will be based again on inflation. Therefore, the voting results from early February do not imply a "dovish" stance from the central bank.

From a technical perspective, we observed a strong correction on the 4-hour timeframe following a 500-pip rise. This correction takes on a classic form, consisting of three waves. Thus, we assume that the correction is complete and that the British pound may resume its bullish journey.

Recently, headlines about Donald Trump have disappeared from news columns and online publications. The American president is currently occupied with cleaning up his image amid the "Epstein affair," rather than making new threats, tariffs, sanctions, or strikes against Iran. The U.S. leader has also begun to consider the upcoming midterm elections for the House of Representatives and the Senate, scheduled for November. Understanding that a large portion of Americans is dissatisfied with their president (an interesting question: why is this the case if the economy is growing?), Trump is preparing various methods to sway the electorate. In particular, to win over those angered by the actions of ICE and the overall policy of the country, Trump plans to distribute another "$2,000 helicopter money." Well, why not, if the economy is growing at unprecedented rates?

Various exit polls already underway in America show that Republicans may lose at least one chamber. Under the worst (but quite realistic) scenarios, they could lose both. Trump's political approval rating has plummeted to 29%. Thus, over the next 8-9 months, the controversial Republican needs to regain the American people's favor urgently. Experts believe this is the reason why Trump has abandoned plans to seize Greenland and has not introduced new tariffs recently. Well, it remains to be seen whether $2,000 is enough to win over the American public in the elections.

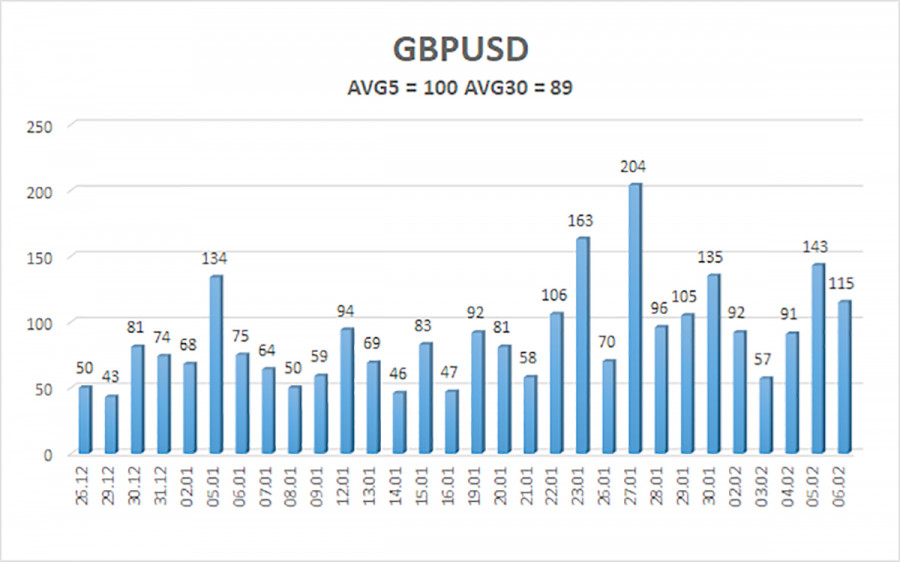

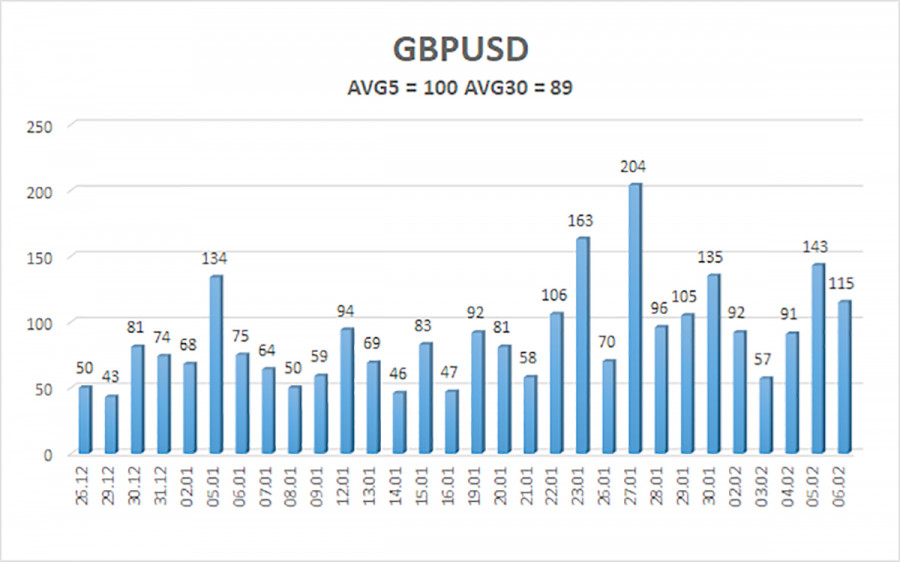

The average volatility of the GBP/USD pair over the last 5 trading days as of February 9 is 100 pips, which is considered "average." On Monday, February 9, we expect movement within the range of 1.3508 to 1.3708. The upper linear regression channel is directed upwards, indicating a recovery of the trend. The CCI indicator has entered overbought territory six times in recent months and has formed numerous "bullish" divergences, consistently signaling the impending resumption of the upward trend. The entrance into overbought territory has warned of the beginning of a correction.

Nearest Support Levels:

- S1 – 1.3550

- S2 – 1.3428

- S3 – 1.3306

Nearest Resistance Levels:

- R1 – 1.3672

- R2 – 1.3794

- R3 – 1.3916

Trading Recommendations:

The GBP/USD currency pair is set to continue its 2025 upward trend, and its long-term prospects have not changed. Donald Trump's policies will continue to exert pressure on the U.S. economy, so we do not expect the U.S. currency to grow in 2026. Even its status as a "reserve currency" is no longer significant for traders. Therefore, long positions with targets of 1.3916 and above remain relevant for the near future as long as the price is above the moving average. If the price is below the moving average line, small shorts can be considered with a target of 1.3508 on technical (correction) grounds. From time to time, the American currency shows corrections (on a global scale), but for a trend to rise, it needs underlying global positive factors.

Explanations for the Illustrations:

- Regression Channels: Help identify the current trend. If both are pointing in the same direction, then the trend is strong.

- Moving Average Line (settings 20,0, smoothed): Determines the short-term trend and the direction for current trading.

- Murray Levels: Target levels for movements and corrections.

- Volatility Levels: (red lines): The probable price channel in which the pair will trade over the next 24 hours, based on current volatility readings.

- CCI Indicator: Entry into oversold territory (below -250) or overbought territory (above +250) indicates an impending trend reversal in the opposite direction.