The EUR/USD currency pair continued to trade within a narrow range on Friday, showing no inclination to either extend its decline or initiate a new rise. On that day, reports on Non-Farm Payrolls and the unemployment rate were expected in the U.S.. Still, the market settled for the U.S. consumer sentiment index and Germany's industrial production. These reports are of secondary importance. Moreover, Germany's industrial production once again came in worse than forecasts, raising the question: Who makes these forecasts? And how do they always turn out to be overly optimistic? In December, production decreased by "only" 1.9%, while traders were expecting a maximum of -0.3%. However, as already mentioned, the eurozone currency did not experience any issues concerning this; the market paid little attention to this report.

The U.S. consumer sentiment index rose above forecasts in February, yet traders ignored it. For most of the day, the European currency rose, contradicting both Germany's production reports and the U.S. consumer sentiment index.

Last week, there were also several speeches by Federal Reserve representatives. Some supported gradual monetary policy easing amid labor market weakness, while others advocated a pause due to high inflation. Nothing new. The FOMC committee remains divided into two factions—the "low inflation" supporters and the "strong labor market" supporters. Notably, neither side has yet achieved its goals, but both factions are constantly tugging the blanket toward themselves.

Overall, most members of the Monetary Policy Committee support Jerome Powell's view that it's best to wait a few months for a 0.75% rate cut to be fully reflected in inflation and labor market data. This data will be published next week. According to forecasts, inflation may slow, while the labor market is expected to remain stagnant and in shock. In our view, three rate cuts will not be enough for Non-Farm Payrolls to start showing 150,000-250,000 new jobs each month as it did in the past. Furthermore, a slowdown in inflation could push the Fed toward an unplanned resumption of policy easing.

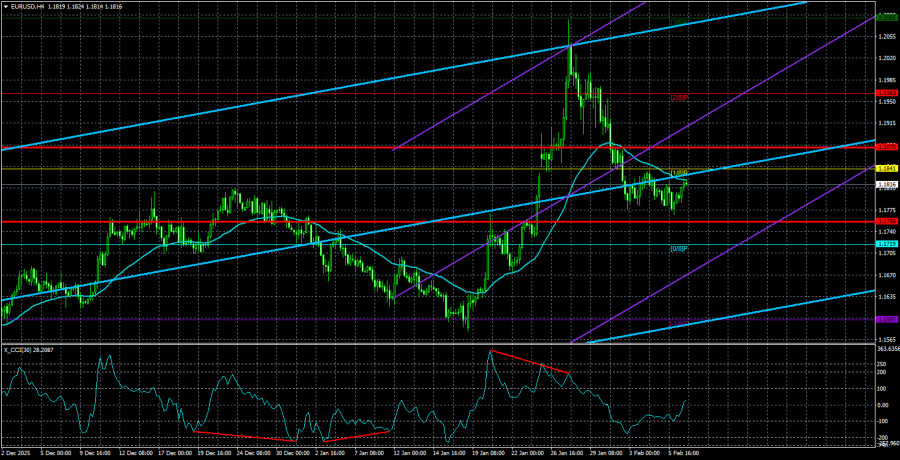

At present, the market does not expect a rate cut in March or April. However, next week, "dovish" sentiments could rise sharply. For the dollar, this would be another reason to renew its downward trend. If the price consolidates above the moving average line on the 4-hour timeframe, it would signal a potential resumption of an upward trend for the EUR/USD pair. Of course, U.S. reports do not necessarily have to turn out weak for the dollar. Additionally, reports often contradict each other. Therefore, at the beginning of the week, it seems the dollar has no path but to drop again. But by the end of the week, the picture may change.

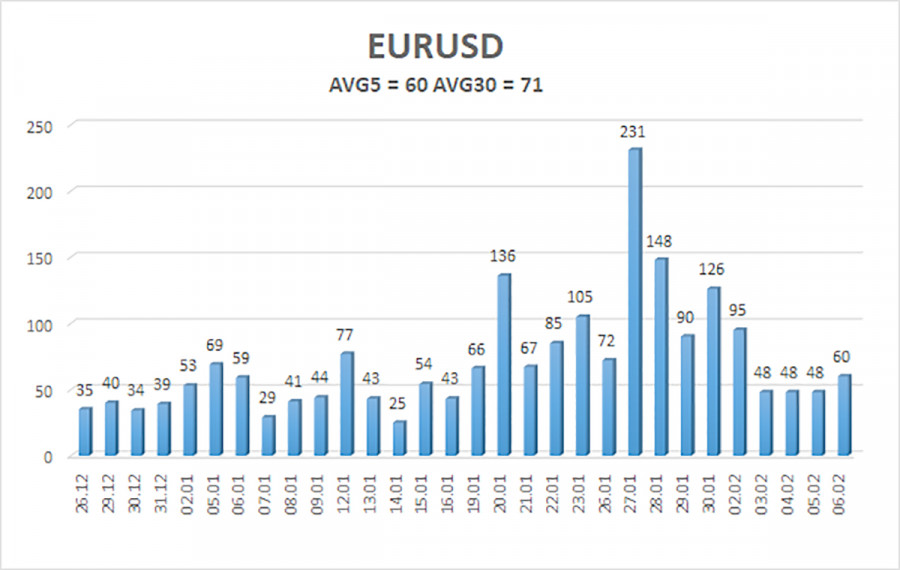

The average volatility of the EUR/USD currency pair over the last 5 trading days as of February 9 is 60 pips, which is characterized as "average." We expect the pair to trade between 1.1756 and 1.1876 on Monday. The upper linear regression channel is oriented upward, indicating further euro growth. The CCI indicator has entered overbought territory, forming two "bearish" divergences that signal an impending pullback.

Nearest Support Levels:

- S1 – 1.1719

- S2 – 1.1597

- S3 – 1.1475

Nearest Resistance Levels:

- R1 – 1.1841

- R2 – 1.1963

- R3 – 1.2085

Trading Recommendations:

The EUR/USD pair continues a strong correction within an upward trend. The global fundamental backdrop remains extremely negative for the dollar. The pair spent seven months in a sideways channel, and it seems that it is now time to resume the global trend of 2025. The dollar lacks a fundamental basis for long-term growth. Therefore, all the dollar can hope for is a range or corrections. When the price is below the moving average, small shorts can be considered with a target of 1.1756 on purely technical grounds. Above the moving average line, long positions remain relevant with targets of 1.1963 and 1.2085.

Explanations for the Illustrations:

- Regression Channels: Help identify the current trend. If both are pointing in the same direction, then the trend is strong.

- Moving Average Line (settings 20,0, smoothed): Determines the short-term trend and the direction for current trading.

- Murray Levels: Target levels for movements and corrections.

- Volatility Levels: (red lines): The probable price channel in which the pair will trade over the next 24 hours, based on current volatility readings.

- CCI Indicator: Entry into oversold territory (below -250) or overbought territory (above +250) indicates an impending trend reversal in the opposite direction.